Double Click to enlarge and view.

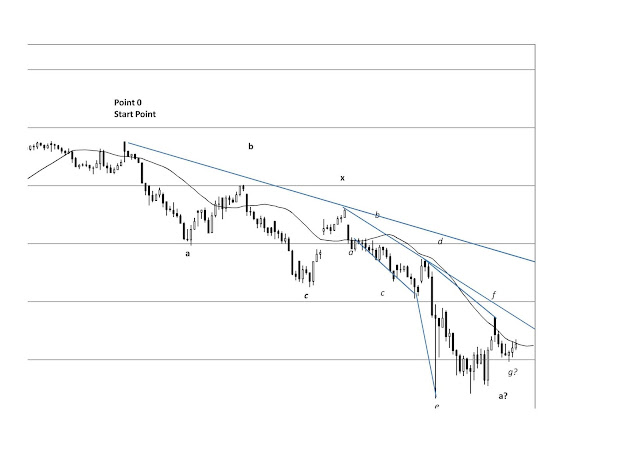

Nifty Spot Dailly Chart EOD 4th Oct, 2018

Weekly parallel channel almost done 10500 around huge support and buy and Nifty must recover 200 DMA quickly. If 10500 breaks and sustains 10100 around will come.

10600/08 Staying below this level

1035010244

10100 - 10111(It should break)

10062 - Should hold and a sharp up-move should start

10111 is the new target for Nifty staying below 10600

Nifty Spot Hourly Chart EOD 26th Sep, 2018

Since bias didn't change or b-d trendline didn't break it may be assumed that the diametric a-leg after x-wave is still not over but structurally looking that it would get over very soon. A Cup and Handle type formation is also visible in the hourly chart.

Nifty Spot Hourly Chart EOD 24th Sep, 2018

One hour chart shows that a-wave down after x-wave from 11523.25 is just about complete or about to be completed with one more move down as a bow-tie diametric. 135-324 points up move may come at some point of time tomorrow. The upmove will have resistances at b-d trendline and 0-x trendline. We have to keep a close eye.

Nifty Daily Chart Analysis EOD 24th Sep, 2018

The 0-b channel has been broken today which Nifty Spot held yesterday. Weak below 10929 only and very strong support near 10800. 17 days from the Top and the correction can take 35 days also. Till the time limit gets over Nifty will have the risk of retracing the whole c-wave from 10677.75 also which could translate into a bear market. Now, Nifty is getting OS in Daily / Hourly and even Weekly / Monthly is at a reasonable level from the overbought situation. It can make another low closer to the last low of 10866.45 as well if sustains below 10929. Otherwise, we may get some pullback soon and this a-leg after the x-wave is about to get over soon. The safe trades are generally when a close above previous day happens in a downtrend. Anticipatory longs can be initiated with low risk close to 10900 levels positionally or at the change of bias.

The time limit allows Nifty to go down upto 10500 levels too, which is another parallel trend line support. The main chart will change if such retracement happens. Oversold bounces can keep coming. Any pullback also remains risky till the time limit gets over or we sustain above 50% retracement levels of the total fall or above the start point of x-wave at 11523.25.

Nifty Daily Chart Analysis EOD 21st Sep, 2018

The sharp fall and pullback suggest a panic bottom probability. The retracement has started and retracement of x-a from 11523.25 to 10866.45 and the 0-x trendline resistance will give the hint of the nature of the second corrective. Once that is found out the rest of the details can be worked out. 11195 / 11273 / 11392 are key resistances and 11117-11156 Strong Support.

Nifty Daily Chart EOD 21st Sep, 2018

0-b Line got broken today which is the first stage of confirmation and next stage of confirmation is a full retracement of c-leg up to 10677 in lesser time. The corrective down move now has to retrace 10677 in another 22 days while it has completed 16 days to today. If that happens we have started the bear market already.We may get a clear picture this week if a triangle is forming from the last low.

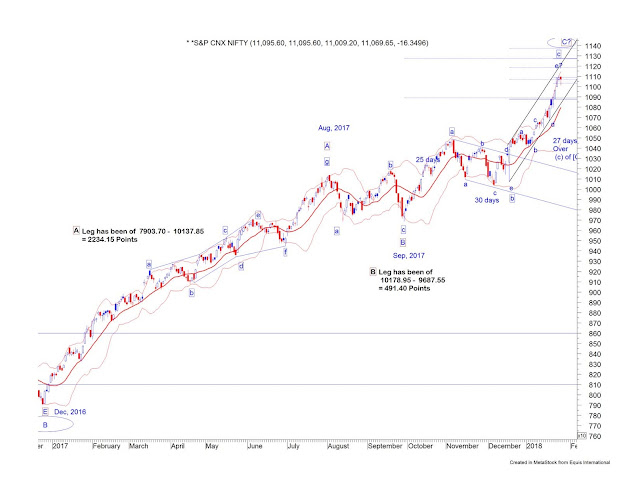

Conventional Elliott Wave Weekly Chart EOD 18-9-2018

The conventional Elliott Wave Chart also suggest that 11200-11300 is a huge support and will be difficult to break on a closing basis.

Nifty Daily Chart EOD 14th Sep, 2018

Nifty Daily Chart EOD 12th Sep, 2018

Nifty has completed an a-b-c correction from 11752. Now it is a buy above 11386 on Friday. The fall from 11750 was 8 days today at 11250.20. We have to see How much retracement takes place and at what speed. We have to see the retracements to find out if the fall got over at today's Low. 1st Target for this up-move is 11651-11668. for Nifty Spot. On the way following will be the resistances 11426 / 11442 / 11469 / 11501 / 11532 / 11561 / 11651-11668.

Nifty Daily Chart EOD 11th Sep, 2018

a-b-c completed for G-leg up and now we are in for d-leg down of it, which should take about 35 days. So, 6-10 days done for correction and 25-29 days left. That would mean that correction can complete earliest by 22nd oct, 2018. Price Target of this correction is a break of the 0-b trendline first and the red line below at about 10859. We are also observing 2-3 days of fall and 2 days of pullbacks. The fall pattern is not clear yet. Present fall from 11603 may stop around 11245 or 11185.85 - 11210.25 previous gap. 112-210 points pullback may come anytime now.

Nifty Daily Chart EOD 12th July, 2018

Contracting triangle breakout has happened and a Narrow range month breakout has also happened. 28 days to a-leg, so, c-leg may take a similar time frame. Maximum corrections can be 150-200 points whenever but the up-move should continue!

Nifty Daily Chart EOD 5th July, 2018

Nifty Spot probably is near completion of the b-leg of correction as a contracting triangle. All dips to 10650-10700 should be good for positional buying and an up-move is expected soon. Buying in Index future is good positionally. 400-650 (Approx) points up-move should come after completion of the triangle. Positional S/l is 10557. On the upside d-leg shouldn't break above 10893 without e-leg else a flat correction will have to be assumed.

Nifty Daily Chart Intraday 30th April, 2018

Nifty Spot is nearing completion of its first leg of the new up-move (Likely) or it could also be New up-move itself. What it is we shall come to know soon. A diamond diametric from 4-4-2018 is in its last g-leg now and should finish within 10850. Risk reward doesn't favour a long trade from here and we would be better off to see the correction and reenter the trade.

Nifty Daily Chart EOD 25th April, 2018

40/43 days fall is now being retracted and we have completed 15 days from our chart completion bottom. We can assume Nifty has completed the a-leg of this up-move near 10638 and formed a double top resistance. Now history shows us 3 weeks of consolidation near 10600-10650 zone before the fall down to 9950(Approx) so we can expect 2/3 weeks of time spending near the zone. The Monthly higher low is also pending for Nifty for the Month of June. 10400-10450 huge support and 10600-10650 is huge resistance and some time spending is needed in the zone. the unconfirmed b-leg correction can take 13 days or more like first a-leg up

Nifty Daily Chart Midday 10th April, 2018

The Second corrective after X-wave from 10478.60 had probably formed an extracting triangle and the correction got completed at 10111.30 on the 4th of April, 2018. Final confirmation needed when Nifty crosses the X-wave commencement point at 10478.60 and sustains. At present handling the OB situation with time correction without much price damage.

Nifty Daily Chart EOD 6th April, 2018

In the chart, the first correction was a truncated ZZ and after an x-wave 2nd corrective is now ongoing. The second leg of correction is happening as a Flat or triangle or it may even be diametric. The a-leg of the second corrective was 8 days and yesterday we probably have ended the b-leg of correction in 8 days (Confirmation needed!). In 1-2 weeks time, the final bottom should be made for this round of correction. During this round of correction if 10182 for Nifty Spot and 24356 is held for Banknifty Spot then b-leg of second corrective will continue to move up again.

Nifty Daily Chart EOD 23rd Mar, 2018

Nifty is correcting the rise from 7893.80 to 11171.55 and 9919.45 (Approx) is 38.2% retracement level and 9532.65 (Approx) is 50% retracement level. 6825.80 and 7893.80 trendline support is around 9800 levels this month and will rise next month. 9770 - 9850 - 9930 Strong Gann Support. Let us see!

Nifty Daily Chart EOD 19th Mar, 2018

We are correcting the rise from Dec 2016 to 1st Feb 2018 (7893.80 Low - 11171.55 High). The rise was a Diamond Diametric and it seems we are nearing completion of the A-Leg down of the correction and B-Leg up may start soon. The Rise was about 13 Months plus.

Nifty Daily Chart EOD 9th Mar, 2018 (Revised)

In the chart resistance lines are visible. I see a triangle or a diametric formation and if that is so we are going up for x-wave. This is very tentative labelling and can change. let's see if we can break into the earlier 10400-10600 band (approx) again and x-leg can target upper band resistance line or more also!

Nifty Daily Chart EOD 2nd Feb, 2018

About four-month-old C-Leg under Major [C]-leg has ended at 11171.50, which is also a key resistance for some short-term top. Now we are in the D-Leg down under probable diamond diametric under Major [C]-leg that started from Dec 2016. Expecting Nifty to come down to around 10300 level or test the thick black [B]-[b] line at least!! Next 1-3 months stocks accumulation for next round of rally! Expect high volatility and fast moves.

Nifty Daily Chart EOD 30th Jan, 2018

e-leg of lower level c-leg of one level higher c-leg top was made on the 29th of Jan, 2018 at 11171.55 and now nifty is coming down for the f-leg and this may at the most test b-d line around 10915-10940 zone or other calculations tell us f-leg may conclude roughly between 11023.80 and 10981.60. The final g-leg up of higher level c-leg is due thereafter and which could last for 6/7 days and retrace 61.8% atleast (failure) or to be of large size and rally 400 points plus as well. We will wait and watch. The correction after completion of g-leg should last about 30 days or so and this correction also can be worked out seeing the structure. The budget should take care of the formation. We may have completed c-leg of higher level c-leg of 10900 breaks.

Nifty Daily Chart EOD 25th Jan, 2018

Nifty is in the e-leg inside c-leg of heigher level c-leg. e-leg got over above 11110.8 or not will be clear if this sidewise correction lasts for more than 3 days (only one day old till now)10877/10890/11000 must hold and (11100-11300) is the Key resistance for (11600-11700)-11900 - 12176/12450

A 300 point like correction should come either next week or from Feb 3rd week for atleast 30 days.

Budget is ahead so if it can take it to 11600 or not needs to be seen. Nifty is at overbought levels hence caution on very strong upmove as some sharp correction may also keep coming from time to time.

Nifty Daily Chart EOD 16th Jan, 2018

Nifty reversing from Channel top it had hit on 15-1-2018. Some retracement / sidewise moves was needed prior to any further up-move to create room. 10683 Spot should hold for the time being for more upsides. Whether larger c-leg from Sep, 2017 will complete or smaller c-leg of larger Sep, 2017 c-leg will complete here we have to understand to measure the price time /correction that is likely soon. Channel top to bottom moves are getting done hence in corrections we have to track the same. However, the current up-move can continue for another 5 to 10 days or more as well. 10800 onwards strong resistance and 10890 plus stronger upto 11060.

Nifty Daily Chart EOD 10th Jan, 2018

c-leg of Major c-leg of one level higher C-leg going on . Higher C-leg Started from 7893.80 (26-12-2016), Major c-leg of one level started from 9687.55(28-9-2017). c-leg Started from 10074.80(18-12-2017). Stiff resistance from 10616-10643-10684, if cleared next resistance is at 10806 - 10877/10891 initially. Gann Support zone 10570-10608-10650. Gann Resistance Zone 10730-10850-10890-10972.

Expected time left for lowest level c-leg as par chart is about 9 to 14 trading days.

Nifty Daily Chart EOD 29th Dec, 2017

The Major C-leg commence from Dec, 2016 from 7893.80 Nifty Spot should complete in 19-21 Months as the previous two legs. That gives us a time target of June, 2018- Aug, 2018 might be the likely completion date for C-leg.

Nifty Daily Chart EOD 8th Dec, 2017

The C-leg major started from Sep, 2017 probably as a diametric or a triangle. Presently the b-leg of Major C-Leg in progress (Which could be over also). May be b-leg has ended as a flat on 6 Dec or after a flat and X-wave is under progress. We need a faster retracement of the last fall to get a clear signal of whether some more downmoves and colidation is left as continuing b-leg. Let's see.

Nifty Daily Chart EOD 17th Nov, 2017

If Nifty spot weakens from here and unable to take out 10345 the this rally was b-leg up of higher level b-leg which remains unfinished. If Nifty proceeds from here to new highs then larger c-leg up is going on. Since Nifty is quiet overbought in Hourly there may be a possibility of a c-leg down within larger unfinished b-leg next week. Now if Nifty spot takes out 10345 from here then we will be left with upward c-leg itself. Let us see what market does?

Nifty Daily Chart EOD 16th Nov, 2017

We have completed b-leg and started c-leg of higher level C-leg or not will be confirmed in due course. Nifty has pullback back to the resistance line 10230 around and next key resistance comes near 10350-10360 and above this probability of upside c-leg of major C-leg rises.

Nifty Weekly Chart Week ended 20th Oct, 2017

Recall

My 2013 prediction of Nifty Targets has almost come true!! The chart is presented below and still Lying in Nifty Weekly Menu option!

Nifty Spot Hourly 28th July, 2017 at 2.45 PM

Nifty Spot is clinging on the uptrend line as of now a convincing close below the 9665 level along-with bias change needed today for confirming d-leg commencement else this might be a b-leg withing c-leg of the main 3rd corrective diametric.

Nifty Spot EOD 27th July, 2017

Nifty Spot Dailly Chart EOD 21st July, 2017

Nifty is now in the b-leg of the 3rd corrective of which a-leg was from 9948.75 - 9928.20 and b-leg started from 9928.20 and is probably forming a triangle. Previous b-waves took maximum 6 days so we wait to see when this one concludes with a move up above 9928.20. Triangles are difficult to trades and best for deep in the money option writing. The third corrective like to form another diametric.

Nifty Spot Dailly Chart EOD 17th July, 2017

Nifty currently in third corrective a-leg and targetting price / time similarilty with a-leg of 1st corrective. Let's see what comes up.

Nifty Spot Dailly Chart EOD 7th July, 2017

c-leg down of nifty 2nd x-wave likely now on Monday supported by SEBI P-note ban. Now that will be true if Nifty spot is able to take support above 9075.15 preferably in 9200-9400 range then after this another round of upmove will take place as 3rd corrective else a deeper correction is price and time likely. Let's see what comes up! Charts can change accordingly as well.

Nifty Spot Dailly Chart EOD 3rd July, 2017

Probability of a 2nd x completion and 3rd corrective upmove is now under consideration which is subject to making a new high on the index within next 3/4 days incl. today. Let's see!!

Nifty Spot Weekly Chart EOD 29th June, 2017

If 7907.30 was a significant top we have reasons to worry!

Nifty Spot Chart at 3.10 PM 29th June, 2017

Nifty Spot Intraday Hourly Chart at 11 A.M 27th June, 2017

It seems we have topped out in the short term and the pattern from 9088.75 or 7398.8 is complete. We will find out soon! Final confirmation of breakdown of b-d line is due which is around 9460 today. Sell on Rallies now onward till this downward pattern ends (small confirmation is due though).

Nifty Spot Intraday Hourly Chart at 2.45 P.M 19th June, 2017

Last Leg of the 2nd corrective diametric have started since 16th June. a-leg of diametric was about 3 days and about 278 points. Let us see where g-leg ends?

Nifty Spot at EOD 14th Jun, 2017 - Neowave count

Last leg up which is g-leg pending for Nifty and we are currently in f-leg of the diametric. 9610 Gann Number is supporting 9880 is the next major resistance. After f-leg g-leg can continue another 7-8 days or more. Thereafter a good correction is expected!

Nifty Spot at 11.30 AM 13th Jun, 2017 - Neowave count

If yesterday's low was completion of f-leg then it will move up else it will go back for a lower low. Now if it has to go up it has to break the upper trendline

Nifty Spot EOD 6th June, 2017 - Neowave Chart

e-leg might have concluded at day high of 9709.30(Crucial). This may get confirmed with a bias change bar. The target may be previous breakout area and the correction may last similar to the previous corrective legs to this rally!

Nifty Spot EOD 2nd June, 2017 - Conventional and Neowave Chart Combined (Corrected)

Nifty Spot Daily EOD 24th May, 2017 - Alternate Count

Count valid is 9272 not retraced!

Nifty Spot Daily EOD 24th May, 2017

If Nifty can save the retracement upto 9269-9272 in next 3 days the retracement may change to d-leg and the 2nd corrective converts to a diametric!

Nifty Spot Hourly EOD 23rd May, 2017

Bearish Head and Shoulder in Nifty Spot Hourly Chart. Staying below 9372 will take it to 9230.

Nifty Spot Daily EOD 18th May, 2017

Nifty Spot as on EOD 11th May, 2016

Nifty Hourly and Daily Chart at 12 Noon 5th April, 2017 - Revised Chart

Nifty is now in it's last g-leg of upmove from 7893.80 after which some x-wave (Minor correction) or a major correction can be expected! a-leg, c-leg and e-leg have consumed between 9- 19 days and b-leg, d-leg and f-leg have consumed 6-7 days. now the last leg i.e. g-leg is ongoing and have consumed 6 days till today and it may go on upto 14 days. The maximum limit of this structure to complete is 9560 around as par previous ending triangular pattern completed at 7893.80. The resistance and maturity points can also be around 9376 or 8472 level. Let us see!

Nifty Spot Hourly Chart 2.55 PM 29th March, 2017

Probable Bow-Tie Diametric forming in the g-leg of the higher level Diametric. The diametric is currently is in it's e-leg.

Nifty bearish pattern at 11.30 am 28th Mar, 2017

Holding below 9133 the pattern may have negative implication which may get confirmed below 9019.30, where the g-leg would have ended as a contracting triangle.

Nifty Hourly Chart at 11.30 AM 27th March, 2017

Nifty Spot 30 Min Chart as on EOD 16th Mar, 2017

The last g-leg of the diametric after completion of correction at 7894 in the form of Neutral triangle is going on. g-leg can take 6 - 13 days or more. There may be a major correction or a minor x-wave correction after completion of g-leg and thereafter another leg to the current rally may emerge. Minimum target of this rally was 9560 with +/- 3% allowed variance. Holding 9000 around may take the rally to much bigger highes in future.

Update on Nifty Spot as on 13/2/2017 12.20 PM

Nifty is almost refusing to settle much below 8800 as of now this is good news for bulls. Uptrend can resume again above 8850. Current upmove target for Nifty spot is 9500 or atleast a new high before end of March, 2017 (Failure will have long consolidation impact on Nifty).

Nifty Hourly Chart at 12.30 PM 24th Jan, 2017

Nifty Spot Daily Chart as on 23rd Dec, 2016

Minimum 60% retracement target was about 7683 for the upmove from 6825.80-8968.70. It can also hit 70% (7469) ! The tolerance level is 1-3% see the news flow somewhere around 7500-7700 or more is easily possible. Though current level is also is in the target achieved range of 1-3% tolerance. Certain other implication of internals can conclude the larger wave e around this level as well. Next couple of weeks may give a clearer picture.

Nifty Spot Daily Chart as on 18th April, 2016

Nifty Spot Daily Chart as on 28th Jan, 2016

The a-leg of new upmove was over on 25th and the corrective b-leg is going on. Time equality will be achieved with a-leg after today. Faster retracement will confirm completion of b-leg and commencement of c-leg.

Nifty Spot Daily Chart as on 22nd Jan, 2016

After completion of 2nd Corrective on Wednesday i.e. 20th Jan, 2016 at 7241.50 ending the g-leg of the bow-tie diametric Nifty has started moving up now. Close above 7470.90 will confirm upside. 1st Target 7500-7600 , 2nd target 7675-7725 and thereafter 0-X line. Present strategy should be to buy on dips as long as Nifty continues to make HH/HL structure and maintain the positive bias.

Nifty Spot Daily Chart as on 12th Oct, 2015

Price movement has confirmed the end of one leg and commencement of another. Now we would need close below previous day to conclude confirmation of another leg. The chart is self explanatory.

Nifty Spot Daily Chart as on 29th Sep, 2015

Nifty correction as a-leg of the entire correction or the correction itself is getting completed as an extracting triangle or a diametric. Let us see what it is! Breakout above b-d line will be the confirmation that the correction is over. Nifty correction as a-leg of the entire correction or the correction itself is getting completed as an extracting triangle or a diametric. Let us see what it is! Breakout above b-d line will be the confirmation that the correction is over. In 6 days including today Nifty has to attempt 8055 plus for faster retracement of the last leg. Which will confirm the correction over or larger a-leg of correction over. In both cases Nifty has to move up. Else a diametric second leg of corrective is still going on and will take some more time to get over.

Nifty Spot Daily Chart as on 28th Sep, 2015

Nifty probably forming a bullish extracting triangle for completion of the corrective phase. The break of b-d line will confirm the bullish upmove.

d-leg ended and swiftly Nifty has moved down for the e-leg of the diametric. Let us watch out for the next 2 days.

Nifty Spot Hourly Chart as on opening hour 16th Sep, 2015

Ahead of FED the chart looks like this. Day end carrying longs is risky unless Nifty Spot closes comfortably above 7894 and Hourly Oscillators aren't overbought.

Nifty Spot Daily Chart as on 14th Sep, 2015

We are probably having rally as the d-leg up of the diametric moment. 7881 and 7966 are the key resistance. 7966 is the equality with the b-leg for the d-leg and if this move goes beyond 7966 or not would determine whether the shape of the diametric is a bow-tie or a diamond.

Nifty Spot Hourly Chart at 3 P.M as on 10th Sep, 2015

Probably an inverted H&S is forming on Nifty Spot hourly chart with breakout above 7850, so long as 7700 (round about) is holding, no worries. The chart would have to match with count too! If this breakout happens Nifty Spot can have another 300 points rally.

Nifty Spot Hourly Chart for EOD as on 8th Sep, 2015

The 2nd corrective probably forming a diametric and we are up for the d-leg formation of the diametric. The key resistances are 7806 / 7883 / 7967 and Nifty should turn for it's e-leg from any one of these points. Above 8092 the count is out of contention. The leg should last for 12 - 20 Hours or more.

Nifty Spot Daily Chart for EOD as on 4th Sep, 2015

The first round of correction after the x-wave may have got over at friday's (4th Sep, 2015) low and holding 7626.85. Price went close to channel support and last rally was 424.30 Points. We have to watch for retracement levels from here if Nifty Stops making new lows.Today it should not close below 7626.85.

Nifty Spot Daily Chart for EOD as on 3rd Sep, 2015

This week's 3-4 day fall could not retrace the last week's 3 days rally fully. Only 92% has been retraced in more than 100% time. So, the activity is marked as b-leg of "b". Yesterday's rise could be c-leg of "b" and today's fall may be the commencement of larger "c"-leg down. Now confirmation of "c"-leg down would be initally to break below 7795 channel bottom and followed by a close below 7699!! Else we may have to revisit count.

Nifty Spot Daily Chart for EOD as on 27th Aug, 2015

Clearly we are into b-leg of the 2nd corrective after x-wave completion as an symmetrical triangle at around 8500. The sharp and violent fall upto 7667.25 was a-leg and now b-leg up is continuing and it has made a high of 8061.95 till now. The 50% and 61.8% retracement marks are at around 8080 and 8180 levels. These two are the critical retracement markets which would determine the crucial structure of the 2nd corrective. We have to wait and watch here and the bias has turned up yesterday. 61.8% retracement is necessary to prove the fall was not an impulse.

Nifty Spot Daily Chart for EOD as on 24th Aug, 2015

Nifty has completed an x-wave and have started with second leg of correction. The a-leg down of the 2nd leg of correction may conclude on 25th morning (Tuesday). Nifty is likely to pullback for b-leg up thereafter. 7723.85 is the place of strong support. If this doesn't hold risk for 7500 is high.

Nifty Spot Daily Chart for EOD as on 30th July, 2015

Third corrective a-leg done and b-leg going on or over will be confirmed soon.

Nifty Spot Daily Chart for EOD as on 8th July, 2015

Corrective action continues after the 1st leg up of the 3rd leg of up-move after the 2nd x-wave. Holding about 8320-8340 zone Nifty will bounce back to recent highs once again.

Current fall is d-leg of the probable triangle now b-leg was 3 days and c-leg started from the 4th day. So d-leg should also for may finish on 3rd /4th day i.e friday/Monday(coming) if the parallel line drawn through b of a-c line is broken d-leg will be bigger than b-leg. and might favour a diametric as well. So, buying closer to 8300 is advisable.

Nifty Spot Daily Chart for EOD as on 6th July, 2015

A very bullish picture for Nifty Spot has emerged and the target for Nifty by Dec, 2015 can be between 9590/9780-10450/10640.

Nifty Spot Daily Chart for Intraday as on 3rd July, 2015

Probably correction over for the first leg up at 8195.65!!

Nifty Spot Hourly Chart for Intraday as on 29th June, 2015

g-leg down in progress and holding around 8150-8200 would be a confirmation.

Nifty Spot Daily Chart for Intraday as on 26th June, 2015

Breakout of range will show direction. Nifty has a task in hand failing which bearish options will remain open. The task is to retrace the high of 8490 within next week!! As long as bias remains positive the positive options are open.

Nifty Spot 4 Hourly Chart for EOD 16th June, 2015

Completion of c-leg as diametric could be confirmed above 8191 Nifty Spot. Nifty will find strength sustaining above 8062. Let us see the price action.

Nifty Spot Hourly Chart for EOD 10th June, 2015

Nifty Spot Hourly Chart for EOD 8th June, 2015

7961-8000 Nifty Spot should be able to hold during this round for a pullback to the falling channel. Break above the downward channel important to complete the correction. 7950-8000 biggest support.

Nifty Spot Hourly Chart for EOD 4th June, 2015

Nifty Spot Hourly Chart for EOD 25th May, 2015

We are now in the b-leg down of the current 12 day old uptrend that started from 7997.15. The 8300 zone is strong support on EOD basis for Nifty Spot and dips towards that should be bought. Nifty may remain sidewise for a while before moving up again for the c-leg. Worry will be there if Nifty keeps sustaining below 8300.

Nifty Spot Hourly Chart for EOD 12th May, 2015

Many possibilities exist. g-leg down had to retrace a minimum of 38.2% of f-leg of the diametric, which it has done. Now, the g-leg can go down maximum upto 7770-7800 range as par the present structure. The bias change or faster retracement from here only can confirm that g-leg down is over. Staying cautious and selling on rallies is a better idea till then.

Nifty Spot Hourly Chart for EOD 7th May, 2015

There is a probable diametric structure in Play and sustaining above 8134 Nifty Spot Crucial for 8212 - 8248 and 8283(Max) before it comes down again for a correction. The structure is valid unless 8356 is crossed in 2 days. But it is near about / almost completing(completed?) a short time positional bottom.

Nifty Spot Hourly Chart for EOD 6th May, 2015

Nifty Spot 1st target is 7995(Approx.) and 2nd Target is 7774 (Approx.) in next 7 days (including today) as par the irregular c-failure flat pattern that has emerged. Now 7995-8050 last strong Support Zone to be watched out.

Nifty View intrday 17th April, 2015

b-leg down confirmed after the 10 day a-leg up and may retrace even upto 61.8 - 80% of a-leg. So now the trend is sell on rallies till bias changes to positive. The bull market corrections are normally of 2-3 days and hence monday and thereafter we need to keep an eye on trend reversal, if any.The retracement targets

38.2% - 8625

50% - 8557

61.8% - 8489

Nifty View EOD 13th April, 2015

We are in the a-leg of e-leg up of the third corrective diametric.

Nifty View EOD 27th Mar, 2015

Market likely to have hit the bottom today at 8269.15 and in next 5-6 days the accumulation around the bottom will go on and a trending move may come in April. Another lower low is possible but highly doubtful!! Probable diamond diametric in progress as a third corrective of which a-leg, b-leg, c-leg and today d-leg (may be) completed / almost complete and e-leg up started/will be starting very soon.

Nifty View EOD 19th Mar, 2015

Nifty has completed a very bearish pattern yesterday and unless 8590 (approx.) holds for spot Nifty Nifty is headed down and minimum target could be somewhere around 8400 in the coming days. The updated chart will only be posted upon confirmation break of 8590 Nifty Spot.

Nifty Hourly Chart EOD 10th Mar, 2015

Expect one more rally if 8885.45 holds as g-leg of a fresh diametric inside c-leg.

Nifty Hourly Chart EOD 28th Feb, 2015

The month close has been very good. The chart has been revised. The 3rd corrective diametric c-leg's a-leg was completed in 11 days, b-leg completed on 26th Feb, 2015 (as Double Failure Flat, ended with a terminal impulse) in 18 days and now the c-leg up as opened and has completed 2 days as of now.

Nifty Hourly Chart EOD 25th Feb, 2015

Nifty has indeed formed a complex pattern. Whereas the b-leg of the probable diametric ended with a limiting contracting triangle and left the option for prices to travel back to it apex area at about 8150-8250 zone and it has also ended the e-leg of the probable diametric with an ending triangle leaving scope for maximum retracement upto 8560 level!! Now the labellings may have to be corrected down the line other than the triangles but the scope for prices is wide open as there is a significant event round the corner.

Nifty Hourly Chart EOD 23rd Feb, 2015

The f-leg of the diametric is on it seems after the e-leg completion as a triangle is the likely probability. Let us see the price and time correction. and whether Nifty is able to defend close below yesterday's low.

Nifty Hourly Chart EOD 11th Feb, 2015

Present upmove is either and x wave after the first corrective of d-leg or e-leg has already started. With the upcoming budget the 2nd scenario is more likely. For confirmation we need a breakout above the falling channel and close above mondays gap down area.

Nifty Hourly Chart EOD 10th Feb, 2015

Nifty may have not yet completed the d-leg as yet. The first set of a-b-c was over followed by and x-wave? and now last part could be an ending triangle. So, expect range bound moves and high volatility for next couple of days till a close happens above 8647.

Nifty Hourly Chart EOD 9th Feb, 2015

By principle of neowave Nifty Spot may retrace to either 8320-8380 range or extend the retracement to 8180-8200. Kejriwal factor is negative for the market. Trade with caution market highly oversold so bounces will come from time to time!

Nifty Hourly Chart Intraday 3rd Feb, 2015

Nifty Spot is now on c-leg of the 3rd leg of upmove. Of c-leg a-leg was over at recent high and now b-leg is going on correcting the a-leg.

Nifty Hourly Chart EOD 20th Jan, 2015

The charts had to change after yesterday's upmove. It may be now that the 3rd leg upmove's a and b legs now completed and the c-leg has started from 14th Jan, 2015 and it is once again a dimetric in progress similar to the first two legs.

Nifty Hourly Chart Intraday 16th Jan, 2015

A probable diamond diametric is forming in b-leg up. Target may be 8640 or more (min Target 8486 already done). Upmove may continue for another 2-3 (including today) days before any pause / correction.

Nifty Hourly Chart EOD 6th Jan, 2015

If HCT volatility for next 3-4 days likely and thereafter directional breakout.

Nifty Hourly Chart EOD 30th Dec, 2014

Nifty Hourly Chart EOD 29th Dec, 2014

Nifty Daily Chart Posted Intraday on 12th Dec, 2014

Watch out the falling channel (looks running correction - bearish) on the daily chart and breakout will speedup the moves. Trend is firmly down and breakdown targets may be 8122-8175 on Nifty spot.

Nifty Hourly Chart Intraday 9th Dec, 2014

Nifty Spot May Target between 8282 and 8180 in this downleg, which is b-leg of the upmove for the 3rd corrective. a-leg was an impulse which ED(ending diagonal) as the 5th wave. Watch out for other confirmations mentioned in the blog for downmove termination.

Nifty Hourly Chart Intraday 8th Dec, 2014

Likely d-leg of the diametric in 3rd leg of upmove in progress.

Nifty Hourly Chart EOD 27th Nov, 2014

5th of a-leg of the third leg of upmove in progress. Within 5th 1 and 2 (probably) is complete and 3rd may be starting. Strength above 8534.65 (wave 1) will confirm the same else it may turn lacklustre.

Nifty Hourly Chart EOD 14th Nov, 2014

Holding 8320.35 - 8346.80 zone, the 5th wave for the impulsive a-leg may commence from here. 8465 and 8535 are the two possible targets.

Nifty Hourly Chart EOD 12th Nov, 2014

a-leg probably ongoing as 5 wave impulse and may terminate at any one of the following points

Nifty Hourly Chart EOD 7th Nov, 2014

a-leg of the third leg is likely to complete somewhere above 8400 (or may continue even), let us wait and watch. Nifty managing the OB situation with sidewise moves. Strength remains holding above 8365.

Nifty Hourly Chart EOD 31st Oct, 2014

Nifty Hourly Chart EOD 28th Oct, 2014

Truncated ZZ a-leg after completion of 2nd corrective has implied bullishness. 8050-8080 is significant resistance, crossing which the old highes will be attempted. Nifty is overbought and the black money list submission to S.C is there at about 11 A.M , so caution needed.

Nifty Hourly Chart EOD 16th Oct, 2014

The confirmation of the 2nd leg (as an extracting triangle) of 2nd corrective completion was given by the market yesterday. Which is doing an a-b-c ZZ since then. In which the b-leg was an contracting triangle.Now the contracting triangle may have either completed yesterday at 7893.9 or 7867.6. Now the pattern implication suggests the following targets or completion of the a-b-c at any one of the following levels :

If completed at 7893.9

Target1 - 7732.5 (Done Yesterday)

Target2 - 7678.75

Target3 - 7624.95

If completed at 7867.6

Target1 - 7706.25

Target2 - 7652.45

Target1 - 7706.25

Target2 - 7652.45

Nifty Hourly Chart EOD 13th Oct, 2014

f-leg may have ended as a contracting triangle as depicted in the chart, but would require the final confirmation with a faster retracement of 7972.35 by 2 trading days including today else it will have some more leg down as an a-b-c flat. The bullish crab in hourly chart supports the contracting triangle. 8030 / 8110 / 8190 are the possible initial targets.

Nifty Hourly Chart EOD 10th Oct, 2014

Nifty diametric f-leg seems to be unfinished as yet and probably it is doing a flat a-b-c and c-leg is continuing and as par bullish Carb it has a maximum unfinished target of 7779. So, holding 7779 in Spot, longs may be initiated for g-leg commencing today else the correction in f-leg may go deeper.

Modified Nifty Hourly Chart Intraday 9th Oct, 2014

Nifty Spot should cross 8031 with 2 days to confirm commencement of pending g-leg up for the 7 legged diametric whereas the f-leg has completed as a Zigzag at 7815.75. Nifty now in buy in dips mode from today till bias changes.

Nifty Hourly Chart Intraday 9th Oct, 2014

Nifty Spot has formed a bullish crab in the hourly chart and it may complete the upmove at any of the points as below. Faster retracement of 7970.65 is one more confirmation :

8374.20 - T2

8506.05 - T3

8588.90 - T4

8719.35 - T5

8900.00 - T6

Continue to hold longs positionally monitoring the Positive Bias (starting today, See Education for clarity)

Nifty Hourly Chart EOD 7th Oct, 2014

2nd corrective has ended at 8180.2 with it g-leg as an extracting triangle. Now present downmove may be an x-wave or a Major downmove as the larger diametric G-leg, which time will tell. Nifty Spot is approaching a significant support zone between 7784-7822 and buying may be attempted in this range positionally for a probable retracement of the last downmove or for a new upmove may also start from here.

Nifty Hourly Chart EOD 25th Sep, 2014

The Larger F-leg of the diametric has ended at recent top. The last leg formation has been a distribution pattern in the form of an extracting triangle, which is highly bearish at Top and bullish at bottom. Heavy caution needed as this may be the first a-leg of the diametric G-Leg down.

Nifty Hourly Chart EOD 23rd Sep, 2014

Nifty Spot Hourly Chart EOD 22nd Sep, 2014

Nifty Spot Hourly Chart EOD 17th Sep, 2014

Today's expected gap down suggests that d-leg down is unfinished and likely to go lower. the b-leg range High(7968.25) and Low(7855.95). Price for d-leg is allowed upto 7855.95 but shouldn't break it.

Nifty Spot Hourly Chart EOD 16th Sep, 2014

d-leg may have ended at yesterday's low at 7925.15 and e-leg has started. If extracting triangle then Nifty may be sidewise like b-leg and if Diametric it can go even higher than the last high and it should take 4-6 days.

Nifty Spot Hourly Chart EOD 15th Sep, 2014

Nifty is in d-leg of the probable Diametric or Extracting triangle formation and has also formed an Head and Shoulder. The Head and Shoulder and the extracting triangle is targeting somewhere close to 7940-7970 zone and diametric can end earlier. Nifty may also form an Inverted Bullish Head and Shoulder from here where the Head is getting formed now. Let us wait and watch.

Nifty Spot Hourly Chart 9th Sep, 2014

As discussed yesterday, we are back to the previous labeling as par price action. Currently 4th of c-leg is still unfolding and should complete near about the monday gap area(may get filled as well).

Nifty Spot Hourly Chart 8th Sep, 2014

Now the g-leg up has converted into a probable diametric (Unless we revisit towards 8100) and we are in the e-leg of this diametric. This upmove, which is just 1 day old may continue for another 5 days minimum.

Nifty Spot Hourly intraday Chart 4th Sep, 2014

c-leg of Extracting triangle completed or c-leg yet to complete and elongated ZZ, yet to be confirmed. 8016 should be held for continuation of c-leg EZZ's 5th wave up.

Nifty Spot Hourly intraday Chart 3rd Sep, 2014

Holding above 8022.7 the (iii)rd of 3rd wave impulse is on for c-leg of g-leg of diametric. Watch out for trendline support / resistance.

Nifty Spot Hourly Chart 28th August, 2014

g-leg of 2nd corrective is on and of which a-leg done, b-leg done or running. If b-leg is done the c-leg may have already started (which may be confirmed with strength above the last high 7968.25 only ) else b-leg may continue for some more time in a sidewise fashion. The g-leg of the diametric 2nd corrective may turn up as a ZZ or an Extracting triangle.

Nifty Spot 30 Min EOD Chart 21st August, 2014

Nifty is in g-leg up of 2nd corrective inside larger F-Leg. the a-leg of g-leg up was completed at 7918.55 and at present b-leg of g-leg is ongoing or have completed at day's low at 7855.95 to be confirmed with an EOD close above 7920. Thereafter c-leg up of g-leg will start (started?)

Nifty Spot Daily EOD Chart 18th August, 2014

Nifty has finished a contracting Triangle f-leg at 7540.1 and thereafter started the g-leg up for the 2nd corrective. The limiting (expected) triangle targets are :T1 - 7854.2 (Done)

T2 - 7958.9

T3 - 8063.6

Nifty Spot 30 Min EOD 13th August, 2014

This upmove could be an x-wave after the 1st corrective on the downside or a-leg of g-wave up of the higher level diametric or the g-leg itself (if it crosses 7799.9 today). The g-leg often ends as a failure too. Bias is up hence cautiously optimistic.

Nifty Spot 30 Min EOD 11th August, 2014

7700-7726 Huge resistance for Nifty Spot. The b-d line crossover (at 7700) will confirm end of f-leg of dimetric and commencement of g-leg from 7540.1.

Nifty Spot Hourly EOD 8th August, 2014

Nifty Spot is in the process of making a Bullish Gartley / Butterfly / Crab (Harmonic Trader Terms) and an Expanding triangle (Neowave Trader Terms) with the following Targets :And

Unfinished/Finished Bullish Gartley Targeting 7573.30(Min - Done) / 7551.10 - Done / 7528.25/ 7511.80 /7495.90 (Max) - Target with S/L of 7622 (Aggressive) 7646 / 7656 (Conservative)

OR

Unfinished Bullish Butterfly Targeting 7505.40(Min) / 7495.90 / 7438.70 / 7309.05 (Max) - Target with S/L of 7622 (Aggressive) 7646 / 7656 (Conservative)

Or

Unfinished Bullish Crab Targeting 7352.70(Min) / 7337.35 / 7178.80 / 7163.30 (Max) - Target with S/L of 7622 (Aggressive) 7646 / 7656 (Conservative)

Nifty Spot 30 Min EOD 6th August, 2014

For Expanding triangle confirmation Nifty has to go below 7548 or otherwise Nifty must protect the last 7593.9, which is last week low.

Nifty Spot 30 Min EOD 5th August, 2014

Expanding Traingle or a-b-c Flat over for f-leg would come clear in 3 days. Nifty has to take out or challenge the 7840.95 in 3 days to clarify it's position.

Nifty Spot Four Hourly EOD 1st August, 2014

Bias (See Education on Main Menu) is -ve i.e. down and would mean sell on all rallies till Nifty Spot is able to close above the Previous day high any one of these days. Faster / Slower retracement or Failure to retrace of 7422.15 will give the exact clue as to what is happening.

Nifty Spot Four Hourly EOD 28th July, 2014

f-leg inside second corrective is still as a-b-c(going on) flat on or g-leg inside 2nd corrective completed or a-leg of g-leg of 2nd corrective over and b-leg of g-leg is going on? Time will answer. But it is logical to conclude that 7600-7700 will be big support for Nifty in Spot and all corrections are a big buying opportunity.

Nifty Spot Four Hourly EOD 22nd July, 2014

Now extracting triangle bet is out. Due to the slow nature of the pullback the current rally can also be the b-leg of the unfinished f-leg or g-leg. FII's are building position in Nifty Future. The bias is running positive since 15th July, 2014. A dash towards 8000 plus is coming soon, if not this month then in the next month.

Nifty Spot Four Hourly EOD 18th July, 2014

Nifty Spot is either still in f-leg in the form of an extracting triangle or would be completing g-leg up. Time will give the answer. Either case we would be due for some correction this week. watch out for change in bias or if Nifty spot starts trading below 7685.

Nifty Spot Four Hourly EOD 15th July, 2014

Last g-leg of 2nd corrective of Major F-leg is now in progress. If it is able to cross and sustain 7560-7580 levels it may retrace more of f-leg down. In the process traders must lighten their position and if not start building shorts for future fall in the form of Major G-leg down or another x-wave down for the corrective major F-leg. Any which way a downmove is going to come soon.

Nifty Spot Four Hourly EOD 14th July, 2014

Whether Nifty finished the major F-leg up and started the major G-leg down time will tell. Not breaking 7377 and a rally will probably confirm the unfinished g-leg of major F-leg is still pending. Now after the completion of the 2nd corrective of F-leg one could get an x-Wave down also and thereafter the third corrective inside larger F-leg may also unfold. Lots of options!!

Nifty Spot Hourly EOD 10th July, 2014

f-leg down may be over or about to be over and it may not do a lower low than yesterday. The g-leg up is going to start soon.

Nifty Spot Hourly EOD 8th July, 2014

Nifty has resumed the f-leg of the 2nd corrective 7580 and 7515 are the supports for the day. The g-leg (can end as a failure too) is left here after. Generally the g-leg and f-leg's are taken up very quickly with great speed. Thereafter the major F-leg will complete. Situation is getting bearish for a couple of months.

Nifty Spot Hourly EOD 1st July, 2014

e-leg is in progress of the 2nd corrective diametric. Levels are on the chart.

Nifty Spot Hourly EOD 30th June, 2014

7647.76 plus Nifty Spot can go towards 7703 and 7718. Looks b of 2nd corrective has completed.

Nifty Spot Hourly EOD 24th June, 2014

Crossing of 7663 needed in next 3 days (15 Hour to be more precise) for New High and failure may cause relebelling of the chart. Watch out for Black channel top resistance starting around 6525.

Nifty Spot Hourly Chart EOD 23rd June, 2014

Nifty Spot Hourly Chart Intraday 20th June, 2014

Holding the gap area near 7500 Nifty spot if now breaks out above 7630-7640 in faster retracement the b-leg may be assumed to be over and it may then have resumed the c-leg of e-leg of diametric of the 2nd corrective. f and g-leg's may adjust slightly if some more time is taken to complete the diametric.

Nifty Spot Daily Chart EOD 18th June, 2014

As we can see break of 7500 can bring in a fast fall in the market. The movement of last couple of days is looking risky for Nifty. FII participation has reduced and DII's are selling. There is a possibility of a fall towards 7200-7300 in such a case. Caution is needed.

Nifty Spot Hourly Chart EOD 18th June, 2014 intraday

A diametric may be in the offering as b-leg of the e-leg of the 2nd corrective.

Nifty Spot Hourly Chart 16th June, 2014 intraday

Nifty Spot it out of downtrending channel after completing b-leg of e-leg of 2nd corrective as Elongated Flat. So, with the day's low as Stop Loss, one can go long easily positionally for c-leg up of e-leg of diametric from here.

Nifty Spot Hourly Chart EOD 13th June, 2014

Watch for channel Breakout or continuation7564 + Bulls in command

7522 Big Support

7484.7-7503.7 Gap area Bigger support

Nifty Spot Hourly Chart 13th June, 2014 intraday

Triangle assumption invalidated by Nifty Price movement. Now we are left with b-leg under e-leg of diametric. We have to see if it has completed at the day's low at 7531.15 or further downside is left today / monday. Please refer 11th June chart under Nifty for lower targets. If the market moves up 7622 Nifty Spot the b-leg will be assumed over and c-leg up will be assumed to have resumed. 7522 is the big support

Nifty Spot Hourly Chart 13th June, 2014 opening hours

The triangle may be complete. Triangle Targets

7929

7809

7764

7734

7704

Earlier e-leg Targets

7939

7823

7718

Market may complete the e-leg of the 2nd corrective somewhere near these values.

Timewise may be another 8 days left minimum. one can guess the next target after

a level is crossed i.e. if 7764 is crossed 7809-7823 will be the target and likewise.

Nifty Spot Hourly Chart 11th June, 2014

If 7579.3 is broken the the contracting triangle assumption will be out and a flat correction will come in with the move as b-leg inside e-leg of the 2nd corrective.

The retracement levels are :

7607 - 23.6%

7560 - 38.3%

7522 - 50%

7484 - 61.8%

Flat

c=a gives 7597 (done)

c=1.618 x a gives about 7522

7522 is a genuine buying or support level for Nifty Spot if price breaks 7579.3.

Nifty Spot Hourly Chart Intraday 11th June, 2014

Likely Contracting running triangle going on as b of e-leg of diametric.

Nifty Spot Hourly Chart EOD 10th June, 2014

e-leg of the 2nd corrective on course and may have the following targets in another 11 days or more

7718 - Target 1

7823 - Target 2

7938 - Target 3

Worry only if Nifty spot starts trading below 7563.5.

Nifty Spot Daily Chart Posted Updated EOD 6th June, 2014

This could be the e-leg of the 2nd corrective and may have the following targets7718 - Target 1

7823 - Target 2

7938 - Target 3

Nifty Spot Hourly Chart Posted Updated EOD 4th June, 2014

If e-leg is a triangle it would finish below 7504 else if it moves up above it it may be a diametric in progress. Any retracement to 7300-7350 is a big buying opportunity

Nifty Spot Hourly Chart Posted Updated EOD 3rd June, 2014

e-leg likely to finish before 7504 (last c-leg High) or allowed maximum is close to 7585(approx.) or somewhere close to a-c line. The big weekly resistance is there at 7466 and Nifty may in my expectation would conclude this upleg somewhere close to this.

Nifty Spot Hourly Chart Posted Updated EOD 2nd June, 2014

Holding Friday's Low 7223.1(Nifty Future) and 7217.15(Nifty Spot) Approx., Nifty is likely to move up in e-leg from here else d-leg downmove continues.

Nifty Spot Hourly Chart Posted Updated EOD 23rd May, 2014

Probabilty that the g-leg of the 2nd corrective is happening as a triangle.

Nifty Spot Hourly Chart Posted Updated EOD 16th May, 2014

g-leg completed or not will be confirmed only after a move below f-leg low i.e. around 7080 area of Nifty spot otherwise g-leg is likely to be a flat or a triangle.

Nifty Spot Hourly Chart Posted Updated EOD 15th May, 2014

6980-7020 Maximum intraday downside (Provided doesn't close below this zone) and for f-leg and from here if it clears 7172-7200 it may go up to 7400-7600 as well in g-leg.

Nifty Spot Hourly Chart Posted Updated EOD 9th May, 2014

Alternate Count Intraday

Nifty Spot Hourly Chart Posted Updated EOD 9th May, 2014

Revised Probable count for Nifty Spot is as under :

Nifty Spot Hourly Chart Posted Updated Intraday 28th Apr, 2014

Likely diametric f-leg going on, watch channel breakout. Buy on dips applicable.

Nifty Spot Hourly Chart Posted Updated Intraday 16th Apr, 2014

Extracting Triangle Probability in Nifty Spot

Probably we are in d-leg of the extracting traingle after which the e-leg will again go towards 6800.

The e-leg has to be less than 168.65 points. Preferably between 104 - 135 points.

Nifty Spot Hourly Chart Posted EOD 9th Apr, 2014

Market will turn positive / Buy on dips above 6725.15 Nifty Spot. We have to now watch out the lower black trendline after cross of 6725.15.

Nifty Spot Hourly Chart Posted EOD 31st Mar, 2014

Holding 6658 and the trendline supports, will take Nifty towards our 1st target Zone of 7000. New Black channel may be watched.

Nifty Spot Hourly Chart Posted Pre-market on 25th Mar, 2014

A-leg or first leg of 2nd corrective is still on as EZZ- x -??. c-d-a resistance line needs to be watched on the top.

Nifty Spot Hourly Chart Posted Pre-market on 24th Mar, 2014

Nifty Spot Hourly Chart Posted Intraday 13th Mar, 2014

First corrective a-b-c inside second higher level corrective [a]-leg got over already. Presently we may be in an x-wave thereafter. Nifty Trading in a range therafter. Breakout or breakdown above or below this range will throw more light in Nifty's planned future moves. The trendline supports are clearly there, holding them will ensure continuation of the uptrend. Since the introduction of VIX future trading there has been extremely high volatility in Nifty, don't know if it would be good for the small traders. Trade the levels, charts can adjust.

Nifty Spot Hourly Chart Posted Intraday 10th Mar, 2014

Nifty Daily Chart EOD 7th March, 2014

RSI Overbought First [a] leg of the 2nd corrective is almost achieving time similarity with first corrective [a] leg in another day, some pause or correction can be expected after monday. Let's see how market behaves and guides. Charts can adjust trade the levels.

Nifty Spot Hourly Chart Posted Intraday 5th Mar, 2014

Nifty Spot Daily Chart EOD 4th Mar, 2014

Nifty Spot Hourly Chart EOD 3rd Mar, 2014

Nifty Spot Hourly Chart EOD 24th Feb, 2014

Nifty Spot Hourly Chart EOD 21st Feb, 2014

Nifty Spot Hourly Chart EOD 20th Feb, 2014

Nifty Spot Hourly Chart EOD 18th Feb, 2014

Nifty Spot Hourly Chart EOD 13th Feb, 2014

x-wave continuing.

11th Feb, 2014 10.30 A.M

Time theory suggests that we are in the larger X-wave down or G-wave diametric of which one leg down completed from 6355.6 - 5933.3. Now an upmove is happening correcting the 8 days fall from 6355.6 - 5933.3 and it may retrace 38.2 % (6095) / 50% (6144) / 61.8% (6194) / 80% (6271)/ or more in case of flat) of the last downmove over a period of 8 days or more. After this upmove another downmove will come as the last leg(or more) to complete the correction. If the correction holds 5614 (Approx), this will confirm as X-wave corrective else it will have to be treated as G-leg down and then it may even touch 5000 levels.

8th Feb, 2014

The speedy Fall below 5972.8 has confirmed the upmove from 5118.85-6355.6 as a five legged triangle instead of a diametric as first leg of F-leg of higher level diametric. Now the current fall may be an x-wave or final G-wave down of higher degree diametric. Time and price action would confirm the final thing.

5th Feb, 2014

5th Feb, 2014

4th Feb, 2014

31st Jan, 2014

Strength Above Middle Channel Target Upper Channel and Weak Below Middle Channel Target Lower Channel

Watch out the Fibo lines and b-d Line is the big resistance around 6140-6150 and 5970 is the immediate Target.

Nifty Hourly Chart as on EOD 24th Jan, 2014

Nifty broke down from the raising wedge and is about to test the Lowermost trendline (visible on the chart) near 6185, which will be the crucial support and EOD basis 6250 will be important for Monday (27th Jan, 2014).

Nifty Hourly Chart as on EOD 23rd Jan, 2014

The raising wedge is visible or otherwise a and b legs are over and c-leg is on for an extracting triangle of the G-Leg of the diametric

Nifty Hourly Chart as on 10.30 A.M 14th Jan, 2014

Posted on 10th Jan, 2014

Posted on 8th Jan, 2014

Posted on 6th Jan, 2014

Posted on 4th Jan, 2014

Posted on 3rd Jan, 2014

Tentative Lebelling as on EOD 2nd Jan, 2014

Updated on 31/12/2013 10.30 A.M

Updated on 24/12/2013 EOD

Updated on 23/12/2013 EOD

Updated on 20/12/2013 EOD

To Validate the bullish triangle Nifty has to retrace 6415+ in next 5 - 6 days (Looks possible). Red channel Resistance and other resistances values given on chart. After confirmation first Target 6613.

Updated on 19/12/2013

Updated on 13/12/2013

Nifty at a crucial juncture diametric f-leg should go below 6102(Nifty Spot) minimum and derivatives position is suggesting Nifty Future will remain only weak below 6200 (difficult to sustain below too). Some news may be pending because market could have discounted the bad news of IIP or Inflation by today. Market made lower low till last hour.

Updated on 12/12/2013

Updated on 29/11/2013

Updated on 27/11/2013

Updated on 25/11/2013

Updated on 22/11/2013

Updated on 15/11/2013

Updated on 11/11/2013

Updated on 5/11/2013

Extracting triangle on the first chart. Shouldnt' the point D be below B and then final upmove E ending around A.

ReplyDeleteSo am I right in assuming D should end below 5700?

Thanks Sandy. Are you counting the diametric option out now or is it still open?

ReplyDelete