Saturday, September 29, 2018

Nifty Spot EOD Analysis - 28-9-2018 Additional Points!

As par corrective limit rules the maximum correction should be limited within 10750 around and might get stronger if price sustains over 11022 and get over above 11250. Considering this we can expect high volatility but less of fall and fast pullback as and when the correction gets over. This is based on the present structure understanding. So, October 2018 is likely to be good!

Friday, September 28, 2018

EOD analysis of Nifty Spot

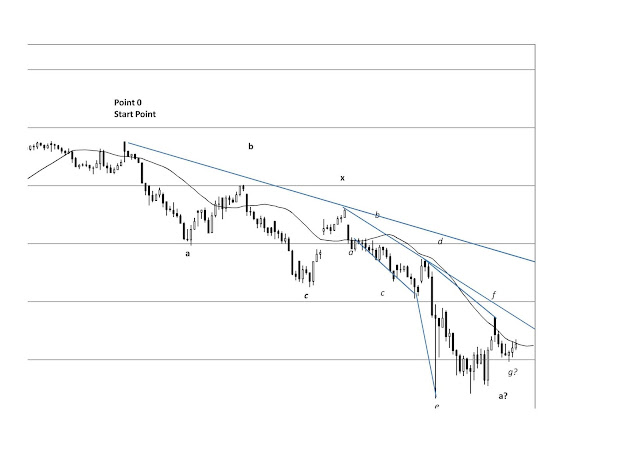

Nifty is falling again and have made a fresh low for the month. Looks like the earlier parallel channel is inviting nifty. It's still getting sold on rallies till we get a bias change confirmation above previous day high. If the black trendline breaks, we may wee 10500 around next week itself to the blue trendline

Labelling later. the correction has a total of 35 days in hand and the minimum retracement target is 10677.75. So, all looks set to achieve as time is in favour and 10929 minus more weakness starts.

Added this part after further analysis

The only part that is positive is the positive divergences in the MACD / RSI / ROC hourly chart. if the black trendline holds with the volatility we may complete one diametric down pattern within Thursday and an up-move can start.

Labelling later. the correction has a total of 35 days in hand and the minimum retracement target is 10677.75. So, all looks set to achieve as time is in favour and 10929 minus more weakness starts.

Added this part after further analysis

The only part that is positive is the positive divergences in the MACD / RSI / ROC hourly chart. if the black trendline holds with the volatility we may complete one diametric down pattern within Thursday and an up-move can start.

Intraday 28-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 11088.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 25290.

Weak Below / Strong Above 11088.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 25290.

Thursday, September 27, 2018

Intraday 27-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 11089.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 25407.

Weak Below / Strong Above 11089.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 25407.

EOD Analysis of Nifty Spot Hourly Chart as on 27-9-2018

Since bias didn't change or b-d trendline didn't break it may be assumed that the diametric a-leg after x-wave is still not over but structurally looking that it would get over very soon. A Cup and Handle type formation is also visible in the hourly chart.

Wednesday, September 26, 2018

Update on Nifty Spot

2-3 day rally it has been the maximum during this down-move so there may be some volatility till tomorrow before Nifty goes up more sharply may be on Friday!

Nifty Spot Update

Next Target and resistance for Nifty Spot are 11207 Rally may get support from Monthly uptrend being month-end this week.

Intraday 26-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 11132.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 25430.

Weak Below / Strong Above 11132.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 25430.

Tuesday, September 25, 2018

Update on Nifty Spot

Some good oversold pullback was done in the morning for 135 plus points. Book out if longs were initiated and wait for a change in bias in the day timeframe.

Above 11017 bulls will be eyeing big.

Above 11017 bulls will be eyeing big.

Intraday 25-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 10993.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 25034.

Weak Below / Strong Above 10993.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 25034.

Monday, September 24, 2018

Nifty Spot Hourly Chart Analysis EOD 24-9-2018

One hour chart shows that a-wave down after x-wave from 11523.25 is just about complete or about to be completed with one more move down as a bow-tie diametric. 135-324 points up move may come at some point of time tomorrow. The upmove will have resistances at b-d trendline and 0-x trendline. We have to keep a close eye.

Nifty Spot EOD analysis as on 24-9-2018

The 0-b channel has been broken today which Nifty Spot held yesterday. Weak below 10929 only and very strong support near 10800. 17 days from the Top and the correction can take 35 days also. Till the time limit gets over Nifty will have the risk of retracing the whole c-wave from 10677.75 also which could translate into a bear market. Now, Nifty is getting OS in Daily / Hourly and even Weekly / Monthly is at a reasonable level from the overbought situation. It can make another low closer to the last low of 10866.45 as well if sustains below 10929. Otherwise, we may get some pullback soon and this a-leg after the x-wave is about to get over soon. The safe trades are generally when a close above previous day happens in a downtrend. Anticipatory longs can be initiated with low risk close to 10900 levels positionally or at the change of bias.

The time limit allows Nifty to go down upto 10500 levels too, which is another parallel trend line support. The main chart will change if such retracement happens. Oversold bounces can keep coming. Any pullback also remains risky till the time limit gets over or we sustain above 50% retracement levels of the total fall or above the start point of x-wave at 11523.25.

Intraday 24-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 11186.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 25701.

Weak Below / Strong Above 11186.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 25701.

Nifty Spot EOD analysis as on 21-9-2018

The sharp fall and pullback suggest a panic bottom probability. The retracement has started and retracement of x-a from 11523.25 to 10866.45 and the 0-x trendline resistance will give the hint of the nature of the second corrective. Once that is found out the rest of the details can be worked out. 11195 / 11273 / 11392 are key resistances and 11117-11156 Strong Support.

Friday, September 21, 2018

Update on Nifty Spot

0-b Line got broken today which is the first stage of confirmation and next stage of confirmation is a full retracement of c-leg up to 10677 in lesser time. The corrective down move now has to retrace 10677 in another 22 days while it has completed 16 days to today. If that happens we have started the bear market already.

We may get a clear picture this week if a triangle is forming from the last low.

We may get a clear picture this week if a triangle is forming from the last low.

Intraday 21-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 11350.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 26512.

Weak Below / Strong Above 11350.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 26512.

Wednesday, September 19, 2018

Conventional Elliott Wave Weekly Chart EOD 18-9-2018

The conventional Elliott Wave Chart also suggest that 11200-11300 is a huge support and will be difficult to break on a closing basis.

Intraday 19-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 11298.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 26514.

Weak Below / Strong Above 11298.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 26514.

Tuesday, September 18, 2018

Update on Nifty Spot

Nifty Spot has reached 50 DMA support and today is the 2nd day of the fall from 11523.25 and we have seen a pullback for 2 days after a fall of 3 days. The pullbacks came about at some point of the third day. Expect a pullback some point of time tomorrow if Nifty chooses to follow the same as before rule. It seems 11250 will be broken for sure. So, we can expect a pullback tomorrow at some point of time or Friday, Thursday is a holiday. The pullback will confirm the structure.

Nifty may stage a pullback from here as well so stay cautious as well.

Nifty may stage a pullback from here as well so stay cautious as well.

Intraday 18-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 11360.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 26857.

Weak Below / Strong Above 11360.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 26857.

Monday, September 17, 2018

Nifty Spot EOD 17-9-2018

In all probabilities, the last rally was an x-wave up completed yesterday at 11523.25 and a fresh down move has started. If Nifty Spot fails to recover above 11404 then this fall may extend tomorrow and if the fall extends also the first resistance of pullbacks will be 11404 in such a case. The fall has been of 156.35 points till date. Going by the previous falls we have observed a minimum 3 days falls have happened always so if no recovery is made tomorrow the fall may extend up to Wednesday. Lower side support is around 11305 and thereafter 11165-11171. T/L and Gann Support are below it closer to 11100.

Update on Nifty Spot

As expected the big gap got filled and 11350 minus S/L now a long may be initiated. for upside, Gap fill up. A pullback rally only is expected. However, 11500 will be difficult for Nifty Spot to clear.

Intraday 17-9-2018

Nifty Future (Bias - Positive)

Weak Below / Strong Above 11507.

Banknifty Future (Bias - Positive)

Weak Below / Strong Above 27167.

Weak Below / Strong Above 11507.

Banknifty Future (Bias - Positive)

Weak Below / Strong Above 27167.

Friday, September 14, 2018

Nifty Spot EOD 14-9-2018 Analysis

11533 Plus Nifty Spot has a resistance near 11561 and thereafter 11652. After a set of bigger falls, one bigger rise has happened of 273.05 points till now. We gave our initial Target as 11651-11668. Now, this up-move can go down and cover the gap again as well next week so remain cautious unless 11561 is not taken out.

Update on Nifty Spot

Can book profit and avoid weekend carry forward with such a big unfilled gap below.

Update on Nifty

Positional Longs were given yesterday with targets and intraday corrections can come.

Intraday 14-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 11461.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 27114.

Weak Below / Strong Above 11461.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 27114.

Wednesday, September 12, 2018

Update on Nifty Spot EOD 12-9-2018

Nifty has completed an a-b-c correction from 11752. Now it is a buy above 11386 on Friday. The fall from 11750 was 8 days today at 11250.20. We have to see How much retracement takes place and at what speed. We have to see the retracements to find out if the fall got over at today's Low. 1st Target for this up-move is 11651-11668. for Nifty Spot. On the way following will be the resistances 11426 / 11442 / 11469 / 11501 / 11532 / 11561 / 11651-11668.

Nifty update intraday 12-9-2018

If no recovery takes place today/tomorrow then sell off may extend to next Tuesday with deeper targets of trendline break.

Intraday 12-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 11343.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 26992.

Weak Below / Strong Above 11343.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 26992.

Nifty Spot EOD 11-9-2018 Analysis

a-b-c completed for G-leg up and now we are in for d-leg down of it, which should take about 35 days. So, 6-10 days done for correction and 25-29 days left. That would mean that correction can complete earliest by 22nd oct, 2018. Price Target of this correction is a break of the 0-b trendline first and the red line below at about 10859. We are also observing 2-3 days of fall and 2 days of pullbacks. The fall pattern is not clear yet. Present fall from 11603 may stop around 11245 or 11185.85 - 11210.25 previous gap. 112-210 points pullback may come anytime now.

Tuesday, September 11, 2018

Intraday 11-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 11474.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 27270.

Weak Below / Strong Above 11474.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 27270.

Monday, September 10, 2018

Intraday 10-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 11588.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 27496.

Weak Below / Strong Above 11588.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 27496.

Friday, September 7, 2018

Intraday 6-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 11564.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 27613.

Weak Below / Strong Above 11564.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 27613.

Tuesday, September 4, 2018

Intraday 4-9-2018

Nifty Future (Bias - Negative)

Weak Below / Strong Above 11624.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 27962.

Weak Below / Strong Above 11624.

Banknifty Future (Bias - Negative)

Weak Below / Strong Above 27962.

Subscribe to:

Comments (Atom)